UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal year ended

OR

For the transition period from __________ to __________

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Common Stock, $0.001 per share

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☐ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

The

aggregate market value of voting and non-voting common equity held by non-affiliates of the Registrant was $

As of March 29, 2023, there were shares of the registrant’s common stock outstanding.

THUMZUP™ MEDIA CORPORATION

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2022

INDEX

| 2 |

PART I

In this Annual Report on Form 10-K, “we,” “our,” “us,” “Thumzup™,” and “the Company” refer to Thumzup™ Media Corporation, unless the context requires otherwise.

Forward-Looking and Cautionary Statements

This Annual Report contains forward-looking statements that involve risks, uncertainties and assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this Annual Report that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 2IE of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect, intend,” “may,” “might,” “plan,” “project,” “seek,” “should,” “target, would” and similar expressions or variations intended to identify forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding:

| ● | future financial position; | |

| ● | business strategy; | |

| ● | budgets, projected costs, and plans; | |

| ● | future industry growth; | |

| ● | financing sources; | |

| ● | the impact of litigation, government inquiries and investigations; and | |

| ● | all other statements regarding our intent, plans, beliefs, or expectations or those of our directors or officers. |

These statements are based on the beliefs and assumptions of our management, which are in turn based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section entitled “Risk Factors” included under Part I, Item 1A below. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Incorporation by Reference

The Commission allows us to incorporate by reference the information we file with it. This means that we can disclose information to you by referring you to those documents. The documents that have been incorporated by reference are an important part of this annual report, and you should review that information in order to understand the nature of any investment by you in our common shares.

| 3 |

RISK FACTOR SUMMARY

Our business operations are subject to numerous risks and uncertainties, including the risks described in the section titled “Risk Factors” included under Part I, Item 1A of this Annual Report on Form 10-K, that could cause our business, financial condition or operating results to be harmed, including risks regarding the following:

Risks Relating to Our Business

The Company is a recently formed company with an unproven business plan, has not yet established profitable operations and has generated minimal revenue.

The Company was formed in October 2020 and has not yet established profitable operations and has generated nominal revenue.

The Company expects to continue to incur losses from operations and negative cash flows, which raise substantial doubt about its ability to continue as a “going concern.”

The Company’s independent registered public accounting firm’s reports have raised substantial doubt as to its ability to

continue as a “going concern.”

The continuing COVID-19 pandemic may have a significant negative impact on the Company’s business, sales, results of operations and financial condition.

The Company may not generate sufficient cash flows to cover its operating expenses.

Security breaches and other disruptions could compromise the Company’s information and expose it to liability, which would cause

its business and reputation to suffer.

The Company is dependent on third parties to, among other things, maintain its servers, provide the bandwidth necessary to transmit content,

and utilize the content derived therefrom for the potential generation of revenues.

Because the Company does not intend to pay any cash dividends on its shares of common stock in the near future, shareholders will not be able to receive a return on their shares unless and until they sell them.

The Company is dependent on key personnel.

The Company may not be able to successfully execute the business plan.

The Company is a new company with a brief operating history, no revenue and an untested business plan which may not be accepted in the markets in which it intends to operate.

The Company has not yet established brand identity and customer loyalty.

The Company cannot assure investors that the Thumzup® App will be accepted.

A better financed competitor may enter the marketplace, cause the Company’s market share or acceptance rates to plummet and adversely affect its ability to sustain viable operations.

Although the Company may own various intellectual property rights, these rights may not provide it with any competitive advantage.

The Company’s future financial results are uncertain and its operating results may fluctuate, due to, among other things, consumer trends, the impact of COVID on advertising budgets and App user activity, competition, and changing social media behaviors.

| 4 |

The Company’s ability to succeed will depend on the ability of its management to control costs.

Key personnel of the Company do not devote full time to the affairs of the Company and could allocate their time and attention to other business ventures which may not benefit the Company.

The Company’s Officers, Directors, and employees are entitled to receive compensation, payments and reimbursements, regardless of whether it operates at a profit or a loss.

Combination or “layering” of multiple risk factors may significantly increase the risk of loss on shares of the Company’s common stock.

Our business is sensitive to consumer spending, inflation and economic conditions.

Russia’s Invasion of Ukraine may negatively impact our business.

Several of our outsourced developers are based in Pakistan and our product development could be impacted by conflict in the Middle East.

We rely on third-party internal and outsourced software to run our critical development and information systems. As a result, any sudden loss, disruption or unexpected costs to maintain these systems could significantly increase our operational expense and disrupt the management of our business operations.

Cyber security breaches of our systems and information technology could adversely impact our ability to operate.

Risks Related to our Common Stock

There can be no assurance that our Common Stock will ever be approved for listing on a national securities exchange. Failure to develop or maintain an active trading market could negatively affect the value of our common stock and make it difficult or impossible for investors to sell their shares in a timely manner.

The Company is controlled by its Chairman/Board of Directors, Chief Executive Officer, President, and additional Officers of the Company.

The Company’s common stock price may be volatile, which could result in substantial losses to investors and litigation.

The sale or availability for sale of substantial amounts of the Company’s common stock could adversely affect the market price of the common stock.

The Company is controlled by a small group of existing shareholders, whose interests may differ from other shareholders. The Company’s Officers and Directors will significantly influence its activities, and their interests may differ from an investor’s interests as a shareholder.

The Company is an “emerging growth company” under the JOBS Act and it cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make the Company’s common stock less attractive to investors.

The Company’s disclosure controls and procedures may not prevent or detect all errors or acts of fraud.

If equity research analysts do not publish research or reports about the Company, or if they issue unfavorable commentary or downgrade its common stock, the market price of its common stock will likely decline.

| 5 |

ITEM 1. BUSINESS.

Overview

General

As used herein, “we,” “us,” “our,” the “Company,” “Thumzup™,” means Thumzup™ Media Corporation unless otherwise indicated. Thumzup™ operates in a single business segment which is social media marketing. Thumzup™ has a mobile iPhone and Android applications called “Thumzup™” that connects brands and people who use and love these brands. For the advertiser, Thumzup™ incentivizes real people to become content creators and post authentic valuable posts on social media about the advertiser and its products.

The Company was incorporated on October 27, 2020, under the laws of the State of Nevada. Its headquarters are located in Los Angeles, CA. The Company has never been the subject of any bankruptcy or receivership. The Company has never engaged in any material reclassification, merger, or consolidation of the Company. The Company has not acquired or disposed of any material amount of assets except in the normal course of business.

In February 2022, the Company was admitted to the Over-The-Counter Venture Market quotation system (OTCQB) under the symbol TZUP.

Thumzup® Products and Services

The Company operates in a single business segment which is social media marketing. The Thumzup® App works on both iPhone and Android mobile operating systems and connects brands and people who use and love these brands. For the Advertiser, Thumzup® incentivizes real people to become content Creators and post authentic valuable posts on social media about the Advertiser and its products.

The Company seeks to capitalize on industry-wide gig economy and business democratization trends. Immense value and opportunity have been created through the democratization of ride sharing, hospitality, finance and other industries. The Thumzup® tools are designed to facilitate this democratization trend for the consumer and the Advertiser within the online advertising space.

The Company has built the technology to support an influencer and “gig” economy community around its Thumzup® App. This technology and community are designed to generate scalable authentic product posts and recommendations for Advertisers on social media. It is designed to connect Advertisers with individuals who are willing to tell their friends about the Advertisers’ products online and offline.

Social Media Marketing Software Technology

The Thumzup® mobile App enables Creators, to select from brands advertising on the App and get paid to post about the Advertiser on social media. Once the Thumzup® Creator selects the brand and takes a photo using the Thumzup® App, the Thumzup® App posts the photo and a caption to the Creator’s social media accounts. The Advertiser then reviews and approves the post for payment and the Creator can cash out whenever they choose through popular digital payment systems. For the Advertiser, the Thumzup® system enables brands to get real people to promote their products to their friends, rather than displaying banner ads that people are tuning out.

A recent Nielsen report found more than 80% of consumers believe friends and family are the most reliable sources of information about products. According to a Pixlee article, 64% of millennials recommend a product at least once a month, and according to a 2019 Morning Consult survey, 86% of Gen Z and millennials would post content for monetary compensation.

The average American adult is expected to spend 8 hours and 11 minutes per day using digital media in 2022 according to Insider Intelligence. The amount of daily usage has increased significantly over the past several years, again according to Insider Intelligence, and the Company believes such usage will continue to accelerate. The Company empowers businesses that want to interact with these Creators and provides tools and data so they can increase consumer awareness and expand their customer bases.

| 6 |

In the past decade, social media platforms like Instagram, Facebook, Twitter, Pinterest, and TikTok have achieved mass worldwide consumer acceptance and created hundreds of billions of dollars in shareholder value. This worldwide viral growth demonstrates that compelling new social media platforms which present the right combination of experience and value, will attract Creators who will invest significant amounts of time on the platforms.

The Company is an early-stage entity building a new real-time platform to support the gig economy. The Company believes that acceptance of its App and revenue growth can be driven by empowering everyday people to make money by posting about what they find to be enjoyable or attractive on social media. The Company believes that the Thumzup® App is a conduit for Advertisers to connect directly with consumers. The Company will need to secure enough Advertisers to make the App an attractive platform for adoption and scalability, and to ensure that the platform is interesting enough for the Creators to return to on a regular basis. No assurance can be given that the Company will be able to achieve these results.

The Industry—Online Advertising

The Company believes that it is developing a new form of social media marketing that does not currently exist, therefore existing descriptions of market size and penetration are not directly applicable. As Thumzup® matures, the Company believes there will be other competitors in this new market of paying non-professional advocates to tell their friends about products they love on social media at the point-of-sale. The closest existing market that is similar to Thumzup’s market is the rapidly growing subset of online advertising called “influencer marketing.” As social media influencers become more plentiful and proven, advertising spending has increased in this space. Brands are estimated to spend up to $4.62 billion on influencer marketing in 2023 according to a 2021 Insider Intelligence forecast[7]. We believe major brands recognize that having their happy customers post on social media is valuable.

Most existing paid influencer marketing platforms were designed for professional and semi-professional online personalities. Some of these platforms have expanded to accommodate “micro-influencers” – people with 5,000 to 30,000 social media followers. In the Company’s opinion, none of these influencer platforms has entered the public consciousness and found mass adoption.

Recent research conducted by TapInfluence has found that influencer marketing content delivers 11 times higher return on investment than traditional forms of digital marketing, and approximately 66% of marketing firms now deploy influencer marketing according to a 2018 Association of National Advertisers survey. A recent Nielsen report found more than 80% of consumers believe friends and family are the most reliable sources of information about products. According to Simplilearn, nano-influencers have an average engagement rate of 8%, more than 4 times that of accounts with more than 1,000,000 followers and further, as an account’s audience grows, its engagement rate tends to decrease. There thus appears to be, in the Company’s view, a clear downward correlation between follower sizes and post likes. Around 66% of marketers now use influencers and nearly half of U.S. marketers plan to increase their influencer budgets according to a according to a 2018 Association of National Advertisers survey. According to a Pixlee article, 64% of millennials recommend a product at least once a month, and according to a 2019 Morning Consult survey, 86% of Gen Z and millennials would post content for monetary compensation.

The Company has designed Thumzup® “from the ground up” to make it easy for brands and service providers to activate people who are not professional influencers but who are passionate about the products, services, or establishments they enjoy or frequent and then are willing to relate those experiences to their friends and other social media followers. The Company has designed the Thumzup App and Advertiser dashboard with Apple-style simplicity and intuitive features to make participation by all individuals seamless with their existing use of social media.

| 7 |

The Company’s first product—Thumzup® App

The Company operates in a single business segment, which is social media marketing. The Company’s mobile iPhone and Android applications called “Thumzup®” connects brands, products, and services to the people who use and love these brands, products, and services. For Advertisers, Thumzup® activates real people to post real product reviews and testimonials on social media with the intention of enhancing brand awareness and reaching targeted consumers more directly and effectively while driving profitable traffic to the Advertisers’ products and services.

The Company is building an influencer and gig economy community around the Thumzup® mobile App that will generate scalable authentic product posts and recommendations for Advertisers on social media and create a technology platform making person-to-person advertising easy, cost-effective, and scalable. The App and Advertiser dashboard are designed to connect Advertisers with individuals who are willing to promote their products and services online and offline.

Social Media Marketing Software Technology

The Company’s Services

The Thumzup® mobile App enables Creators to select from brands advertising on the App and get paid to post about the Advertiser on social media. Once the Thumzup® Creator selects the brand and takes a photo using the Thumzup® App, the Thumzup® App posts the photo and a caption to the Creator’s social media accounts. The Advertiser then reviews and approves the post for payment and the Creator can cash out whenever they choose through popular digital payment systems. For the Advertiser, the Thumzup® system enables brands to get real people to promote their products and services to their friends, rather than displaying banner ads that social media users are tuning out.

With the Thumzup® App, the Company is targeting and seeking to sign up everyday people and gig economy workers who like specific brands and present them with opportunities to be paid for posting about the brands on social media. The Company believes that its management team has the sales relationships, legal, and technology expertise for its current level of development. The Company will need to add additional staff to rapidly grow the business. All source code, development work, and intellectual property performed under independent development or employment contracts paid for by the Company are assigned to and owned by Thumzup®.

Intellectual Property

The Company owns the copyrights to the source code for the Thumzup® App on the iPhone iOS and Android operating mobile operating systems as used on the majority of mobile phone and tablet devices. The Company also owns the copyrighted source code for the “backend” system that administrates the Thumzup® App, tracks payments and advertising campaigns.

The Thumzup® thumb logo is a registered trademark owned by Thumzup® Media Corporation, Reg. No. 6,842,424, registered Sep. 13, 2022. On April 13, 2021, the Company filed a trademark application ser. No. 90642789 with the U.S. Patent and Trademark Office (“USPTO”) for the word mark THUMZUP, which was granted registration on June 21, 2022, resulting in reg. no. 6764158. Also on April 13, 2021, the Company filed a trademark application ser. No. 90642848 for the Thumzup® logo, featuring a stylized hand with an upwardly extended thumb. Meta Platforms, Inc. (which owns and operates Facebook and Instagram) initially filed opposition to the logo on June 30, 2022. Thumzup® agreed to not use the logo as a reaction to a post and Meta Platforms, Inc. subsequently withdrew their opposition on August 5, 2022 and it was dismissed without prejudice.

| 8 |

Business Model

Advertisers purchase a campaign on the Thumzup® website. Once the Advertiser approves a post for payment, the platform facilitates the payment to Creators a monetary amount per screened post which may range from $1.00 to $1,000.00. The Thumzup® platform enables the Advertiser to screen posts so that the Advertiser only pays for posts that are commercially valuable and rewards Creators for posts that have images and text that represent the Advertiser in a positive manner.

Per Post Fee. Thumzup® Advertisers are charged a “Per Post Fee.” By way of illustration, an Advertiser that buys 100,000 posts from Thumzup®, to pay out $10 per post to Thumzup® Creators, would purchase the posts for $13.00 each or $1,300,000. The Creators in this illustration would receive a total of $1,000,000 and Thumzup® would retain $300,000 for its services. The Thumzup® platform would facilitate 100,000 posts for the Advertiser from Thumzup® Creators sharing with their friends about their endorsed products on social media.

Value Proposition

The Thumzup® App is designed to generate scalable social media authentic social media content for Advertisers. It is designed to connect Advertisers with individuals who are willing to authentically promote their products online. The Company envisions that many gig economy workers will be ideal candidates to become Creators posting on Thumzup®. Imagine a gig economy driver waiting for their next fare who takes a moment to post about the good experience they had at their lunch spot where they are waiting. Imagine a gig economy worker on a laptop at a coffee shop doing a graphic design project from a gig economy site who takes a moment to post about the coffee shop where they are working on Thumzup®. The Company believes that Thumzup® can readily provide extra income for this existing pool of gig economy workers. The Company believes these gig economy workers will be able to provide quality Thumzup® posts on social media for which Advertisers will be willing to pay.

Regulatory Compliance

The Federal Trade Commission regulates and requires certain disclosures by social media influencers, specifying when disclosure is required, and how the disclosure should be presented. These rules are codified in the Code of Federal Regulations, 16 CFR Part 255. Specifically, the FTC requires that influencers disclose any financial, employment, personal, or family relationship with a brand. Influencers must disclose financial relationships and consideration paid including any money, discounted products or other benefits paid to the influencer. Creators on the Thumzup platform are being paid to post about Thumzup advertisers. Thumzup puts #ad in each post made on its platform to disclose that the creator has been paid to make the post.

The Company does not believe its compliance with existing FTC regulations will have a material effect on capital expenditures, earnings and competitive position of the Company and its subsidiaries, for the current fiscal year and any other material future period.

| 9 |

Thumzup™ App Workflow

|

For direct-to-consumer (“DTC”) brands, a customer might get a postcard in the box upon receiving a purchase in the mail. A postcard would inform the customer about the opportunity to get cashback by sharing a picture of the purchase with friends on social media. If the Creator takes a picture of the postcard, a link to download the Thumzup® App will appear on the customer’s phone. The illustration to the left and those below are intended as examples only and will not necessarily correlate to a final version or an amount. Actual wording and amounts will depend on agreements with Advertisers, products or brands seeking recommendations and other market factors as may be assessed by management. |

|

For physical stores and restaurants, the Company offers signage to make patrons aware that they can be paid to tell their friends about their positive experience in the store or restaurant.

When Creators open the Thumzup® App on their phones, they will reach a welcome screen which establishes the idea that they can get paid to post about brands, services and places they like with the App. |

| 10 |

|

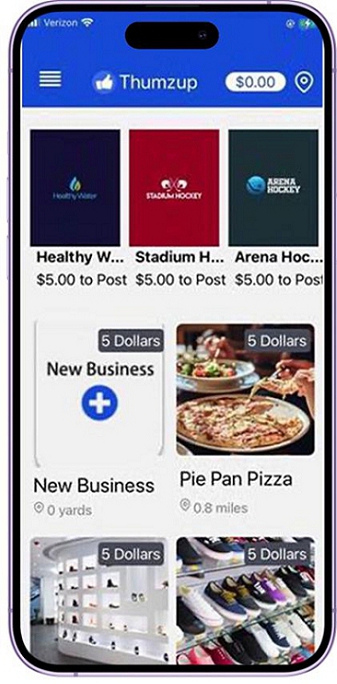

The main screen appears after a Creator enters the unique code the Company sent. The main screen enables each Creator to easily select brands, nearby restaurants, and stores that will pay the Thumzup Creator to post to friends and other followers about products and places recommended by the Creator on social media.

The main screen has seven main areas where the Creator can take action. There is a “hamburger” menu in the upper left to access administrative functions and there is a balance due to the Creator displayed on the upper right. Next, going down the screen there is a search bar, a map tool, a left to the right slider to select brands that will pay for posts, and an up and down slider to select locations nearby that will pay to post. The “hamburger” menu in the upper left gives the Creator access to change bank or payment information, to link to social media, and to invite friends. The balance due to the Creator number in the upper right has the total of monies pending and monies due but not yet transferred to the Creator. |

| 11 |

|

When Creators select a brand or location tile from the main menu, the App enables them to take pictures of their enjoying the product or experience. The App then enables them to customize the caption that will be posted to social media. Once Creators submit the pictures and captions, they get uploaded and displayed on the social media account of those Creators. | |

|

| 12 |

|

Thumzup® inserts the tag required to disclose that the post is a paid promotion. If the Advertiser, in this case at left, a fictional brand called “Wearclick” has chosen to offer a discount code to the Thumzup Creator’s friends on social media, that discount code gets embedded in the post along with the offer.

When the Creator makes a new post, the post is reviewed by Thumzup on behalf of the Advertiser to assure that it meets community standards, does not include sexually explicit images or text, and that the post reflects the Advertiser in a commercially favorable light. For instance, if images are poorly lit or irrelevant to the brand, Creators may be sent text messages to the Creators giving them this feedback and explaining that the post is not due for payment.

When Creators want to receive the money they have earned they tap on the PayMe! selection on the App menu. The App then pays the Creator via online payment systems, such as Venmo or PayPal, the amount due from all screened posts made by that Creator.

The App enables the Creator to search for brands they like that will pay them to post. This is useful so that Thumzup® Creators can easily discover brands they like to post about. The App pays Creators to post about brands. |

| 13 |

|

In the Company’s opinion, paid posts from happy customers about how much they like an Advertiser’s goods or services offer attractive, compelling values to both Advertisers and Creators compared to traditional online advertising because those posts should yield higher response rates. |

The Thumzup® system provides Advertisers with quality control by enabling the Advertiser to review posts to make sure that the posts meet community standards and are commercially useful to the Advertiser. This helps reduce the number of people who may try to game the system to otherwise not use it properly. Thumzup® Creators can opt-in to receive text message from brands. This opt-in opportunity is valuable to Advertiser brands because text messages have higher visibility to potential customers than emails.

The Thumzup® system enables “campaign spend” to be limited by a total dollar amount as determined by the Advertiser. Once the posts that the Advertiser has paid for have been posted and approved for payment, the campaign expires and the Advertiser incurs no additional cost until it chooses to increase the amount. It also enables the Advertiser to limit the number of posts made by an individual Creator by day, week, and month. The Company believes that this feature enables more efficient budgetary control while reducing unintended cost overruns. This feature may eliminate abuse or saturation by Creators who post more than what may be commercially valuable to Advertisers.

| 14 |

Financing Plan

In November 2020, the Company raised an aggregate of $215,000 through issuance of senior secured convertible promissory notes to four holders, which have since been converted and exchanged

into shares of Common and Preferred Stock, respectively, and are now retired. From January 1, 2021 through December 31, 2022, the Company has raised an additional $1,880,412 and $1,260,000 through the sale of its Common and Preferred Stock, respectively, to Accredited Investors in private placements pursuant to section 4(a)(2) of the Securities Act of 1933. These funds have been used to build and beta test the Thumzup® App and to cover operating costs, including other administrative costs and expenses.

During the year 2021 the Company was pre-revenue and transitioned into beta testing. The Company has generated minimal revenue in 2022 from a limited soft launch in Santa Monica and Venice, CA. The Thumzup® App commercial launch began in late 2022 in a geographic region around the West Side of Los Angeles with expansion into other geographic regions planned for 2023 and beyond.

The Company is currently conducting an offering under Regulation A+, pursuant to an Offering Statement on Form 1-A/A filed on December 23, 2022 and qualified on January 9, 2023, through which the Company is offering up to 2 million shares of common stock at a purchase price of $4.50 per share. The Company currently has subscriptions for 64,894 shares for an aggregate subscription amount of $292,023 in escrow as fully described in the Company’s Form 1-A/A filed on December 23, 2022.

Competition

The Company has competitors in influencer marketing software companies as GRIN, #paid, CreatorIQ, Mavrck, Popular Pays, Tribe Dynamics, AspireIQ, Influenster, Traackr, and Hivency. All of the above-named competitor influencer marketing software is focused on influencers who see themselves as professional influencers. To the best of the Company’s knowledge, these competitors are not building platforms designed to turn social media creators into micro-influencers in the manner that the Company seeks to accomplish. Rep is also an app that connects brands with influencers who are interesting in promoting brands. Rep’s app is different from Thumzup® because it is targeting people who consider themselves influencers.

The Company does not currently know of another business that is seeking to build a community of everyday people and empowering them to post about brands that they love.

Nevertheless, the influencer marketing industry segments are rapidly evolving and competitive and the Company expects competition to intensify in the future with the emergence of new technologies and market entrants. The Company’s competitors may enjoy competitive advantages, such as greater name recognition, longer operating histories, substantially greater market share, established marketing relationships with, and access to, large existing advertisers and user bases, and substantially greater financial, technical and other resources. These competitors may use these advantages to offer apps or other products similar to the Company’s at a lower price, develop different products to compete with the Company’s current solutions and respond more quickly and effectively than the Company does to new or changing opportunities, technologies, standards or client requirements particularly across different cities and geographical regions. Certain competitors could also use strong or dominant positions in one or more markets to gain competitive advantage against the Company in markets in which it operates in the future. The Company believes its ability to compete successfully for users, content, and advertising and other customers depends upon many factors both within and beyond the Company’s control, including:

| ● | the popularity, usefulness, ease of use, performance and reliability of the Thumzup® App and services compared to those of competitors; | |

| ● | the ability, in and of itself as well as in comparison to the ability of competitors, to develop new apps, other products and services and enhancements to then existing apps, products and services; |

| 15 |

| ● | the Company’s ad targeting and measurement capabilities, and those of its competitors; | |

| ● | the size, composition and level of engagement of the Thumzup® App user communities relative to those of the Company’s competitors; | |

| ● | the Company’s marketing and selling efforts, and those of its competitors; | |

| ● | the pricing of the Thumzup® Apps and services relative to those of its competitors; | |

| ● | the actual or perceived return the Company’s customers receive from the deployment of the Thumzup® Apps within the user communities relative to returns from the Company’s competitors; and | |

| ● | the Company’s reputation and brand strength relative to its competitors. |

Problems in the market that Thumzup® solves

According to Inc. Magazine, in 2019, JetBlue Airways did a promotion where it offered free travel to people in exchange for posting about JetBlue on social media. The promotion was deemed not to be a success because many of the people reportedly deleted the posts after claiming the reward. JetBlue had no platform for tracking the influencers and holding them accountable. The Thumzup® Platform allows Advertisers to limit and or cap their advertising spend, as well as allowing the Advertiser to approve individual posts prior to the Creator being paid.

Employees

As of December 31, 2022, The Company has four (4) full-time employees, as well as sixteen (16) marketing, sales, and finance independent contractors. The Company also utilizes the services of approximately seven (7) part-time software developers. All of these software developers are third-party contractors and are located outside the United States.

Legal Proceedings

From time to time, the Company may become involved in litigation or other legal proceedings. The Company is not currently a party to any litigation or legal proceedings. Regardless of outcome, litigation can have an adverse impact on the Company because of defense and settlement costs, diversion of management resources and other factors.

Available Information:

Thumzup™ is located at 11845 W. Olympic Blvd, Ste 1100W #13, Los Angeles, CA 90064. Our telephone number is (800) 403-6150 and our Internet website address is www.ThumzupMedia.com.

We file or furnish electronically with the U.S. Securities and Exchange Commission (“SEC”) annual reports on Form 10-K, quarterly reports on Form 10- Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. We make copies of these reports available free of charge through our investor relations website as soon as reasonably practicable after we file or furnish them with the SEC. These reports are also accessible through the SEC website at www.sec.gov. Information contained on or accessible through our website www.thumzupmedia.com is not incorporated into, and does not form a part of, this Annual Report or any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

| 16 |

Item 1A. Risk Factors.

An investment in our in our common stock involves a high degree of risk. The risks described below include the principal material risks to our company or to investors that are known to our company. You should carefully consider the risks described below together with the other information contained in this Form 10-K. If any of the following risks actually occur, our business, financial condition and results of operations could be materially harmed. As a result, should a trading market develop, as to which no assurance can be given, the trading price of our common stock could decline, and investors might lose all or part of their investment.

Risks Relating to Our Business

In addition to the other information in this Annual Report, you should carefully consider the following factors in evaluating us and our business. This Annual Report on Form 10-K contains, in addition to historical information, forward-looking statements that involve risks and uncertainties, some of which are beyond our control. Should one or more of these risks and uncertainties materialize or should underlying assumptions prove incorrect, our actual results could differ materially. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below, as well as those discussed elsewhere in this Form 10-K, including the documents incorporated by reference.

There are risks associated with investing in companies such as ours who are primarily engaged in research and development. In addition to risks which could apply to any company or business, you should also consider the business we are in and the following:

The Company is a recently formed company with an unproven business plan, has not yet established profitable operations and has generated minimal revenue.

The Company has principally funded its operations through the sale of equity and equity instruments, including senior secured convertible promissory notes in the aggregate principal amount of $215,000 (the entirety of which have been converted into either common or preferred stock), the sale of Common Stock yielding gross proceeds of approximately $1,853,500, and the sale of 28,004 shares of Series A Preferred for aggregate proceeds of approximately $1,259,995. As the Company moves forward in developing its technology and commercializing the Thumzup mobile application (the “Thumzup® App” or “App”), or as it responds to potential opportunities and/or adverse events, the Company’s working capital needs may change. Pending its ability to generate adequate cash flow, as to which no assurance can be given, the Company likely will continue to incur significant losses in the foreseeable future for various reasons, including unforeseen expenses, difficulties, complications, and delays, and other unknown events. As a result, the Company will require additional funding to sustain its ongoing operations and to continue its research and development activities. The Company cannot assure that its available funds will be sufficient to meet its anticipated needs for working capital and capital expenditures through any period of twelve months.

The Company’s ability to generate positive cash flow will be dependent upon its ability to recruit and retain Advertisers and Creators. The Company can give no assurances it will generate sufficient cash flows in the future to satisfy its liquidity requirements or sustain continuing operations, or that additional funding, if required, will be available when needed or, if available, on favorable terms.

The Company was formed in October 2020 and has not yet established profitable operations and has generated nominal revenue.

For the year ended December 31, 2022, we incurred a net loss available to shareholders of $1,221,765, primarily due to software research and development expenses of $567,408, marketing expenses of $224,088, and general and administrative expenses of $418,940. For the year ended December 31, 2021, the Company incurred $857,255 in net losses primarily due to $716,524 in software research and development expenses, $102,698 in general and administrative expenses, and $17,486 in interest expense.

The Company expects to continue to incur losses from operations and negative cash flows, which raise substantial doubt about its ability to continue as a “going concern.”

The Company anticipates incurring additional losses until such time, if ever, it can obtain adequate Advertiser support and acceptance by Creators. Substantial additional financing will be needed to fund the Company’s development, marketing and sales activities and generally to commercialize its technology and develop brand support and Creator acceptance. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

| 17 |

The Company will seek to obtain additional capital through the issuance of debt or equity financings or other arrangements to fund operations; however, there can be no assurance it will be able to raise needed capital under acceptable terms, if at all. The sale of additional equity may dilute existing shareholders and newly issued shares may contain senior rights and preferences compared to currently outstanding shares of Common Stock. Should the Company choose to issue debt in the future, such debt securities may contain covenants and limit the Company’s ability to pay dividends or make other distributions to shareholders. If the Company is unable to obtain such additional financing, future operations would need to be scaled back or discontinued. Due to the uncertainty in the Company’s ability to raise capital, the Company believes that there is substantial doubt as to its ability to continue as a going concern.

The Company’s independent registered public accounting firm’s reports have raised substantial doubt as to its ability to continue as a “going concern.”

The Company’s independent registered public accounting firm indicated in its reports on the audited financial statements for the years ended December 31, 2022 and 2021 that there is substantial doubt about the Company’s ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming the business will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if the Company does not continue as a going concern. Therefore, prospective Investors should not rely on the Company balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation. The presence of the going concern note to the Company’s financial statements may have an adverse impact on the relationships the Company is developing and plan to develop with third parties as it continues the commercialization of its products and could make it challenging and difficult for the Company to raise additional financing, all of which could have a material adverse impact on the business and prospects and result in a significant or complete loss of an investment.

There is no assurance that the Company will ever be profitable or that debt or equity financing will be available to it in the amounts, on terms, and at times deemed acceptable to the Company, if at all. The issuance of additional equity securities by the Company would result in a significant dilution in the equity interests of its Shareholders. Obtaining commercial loans, assuming those loans would be available, would increase the Company’s liabilities and future cash commitments. If the Company is unable to obtain financing in the amounts and on terms deemed acceptable to it, the Company may be unable to continue the business, as planned, and as a result may be required to scale back or cease operations, the results of which would be that shareholders would lose some or all of their investment. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

The continuing COVID-19 pandemic may have a significant negative impact on the Company’s business, sales, results of operations and financial condition.

The COVID-19 pandemic continues to adversely affect the United States of America and the world, including in the primary regions in which the Company plans to operate. Additionally, the Company’s liquidity could be negatively impacted if these conditions continue for a significant period of time. Capital and credit markets have been disrupted by the crisis and the Company’s ability to obtain any required financing is not guaranteed and largely dependent upon evolving market conditions and other factors. Depending on the continued impact of the crisis, further actions may be required to improve the Company’s cash position and capital structure.

The extent to which the COVID-19 outbreak could ultimately impact the Company’s business, sales, results of operations and financial condition, will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even after the COVID-19 outbreak has fully subsided, the Company may continue to experience significant impacts to its business as a result of its global economic impact, including any economic downturn or recession that has occurred or may occur in the future.

| 18 |

The Company may not generate sufficient cash flows to cover its operating expenses.

As noted previously, the Company has incurred operating losses since inception and expects to continue to incur losses as a result of expenses related to research and continued development of its technology, marketing expense, corporate general and administrative expenses and interest on the senior secured convertible promissory notes. The Company has principally funded its operations to date through the sale of senior secured convertible promissory notes in the aggregate principal amount of $215,000 (the entirety of which have been converted into either common or preferred stock), the sale of Common Stock yielding gross proceeds of approximately $1,886,500, and the sale of 28,004 shares of Series A Preferred Convertible Voting Stock for aggregate proceeds of $1,259,995.

As of December 31, 2022, the Company had total Shareholders’ equity of $1,069,440, an accumulated deficit of $2,084,707, and cash and cash equivalents of approximately $1,155,343. Although the Company had cash on hand of $1,155,343 as of December 31, 2022, there is no assurance that these funds will prove adequate beyond twelve months.

In the event that the Company is unable to generate sufficient cash from its operating activities or raise additional funds, it may be required to delay, reduce or severely curtail its operations or otherwise impede the Company’s on-going business efforts, which could have a material adverse effect on its business, operating results, financial condition and long-term prospects.

Security breaches and other disruptions could compromise the Company’s information and expose it to liability, which would cause its business and reputation to suffer.

In the ordinary course of the Company’s business, it may collect and store sensitive data, including intellectual property, proprietary business information, proprietary business information of its customers, including, credit card and payment information, and personally identifiable information of customers and employees. The secure processing, maintenance, and transmission of this information is critical to the Company’s operations and business strategy. As such, the Company is subject to federal, state, provincial and foreign laws regarding privacy and protection of data. Some jurisdictions have enacted laws requiring companies to notify individuals of data security breaches involving certain types of personal data and the Company’s agreements with certain customers require it to notify them in the event of a security incident. Evolving regulations regarding personal data and personal information, in the European Union and elsewhere, including, but not limited to, the General Data Protection Regulation (GDPR), and the California Consumer Privacy Act of 2018, especially relating to classification of IP addresses, machine identification, location data and other information, may limit or inhibit the Company’s ability to operate or expand its business. Such laws and regulations require or may require the Company or its customers to implement privacy and security policies, permit consumers to access, correct or delete personal information stored or maintained by the Company or its customers, inform individuals of security incidents that affect their personal information, and, in some cases, obtain consent to use personal information for specified purposes.

The Company intends to take reasonable steps to protect the security, integrity and confidentiality of the information it collects, uses, stores, and discloses, and it takes steps to strengthen its security protocols and infrastructure, however, the Company’s information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, or other disruptions. The Company also could be negatively impacted by software bugs or other technical malfunctions, as well as employee error or malfeasance. Advanced cyber-attacks can be multi-staged, unfold over time, and utilize a range of attack vectors with military-grade cyber weapons and proven techniques, such as spear phishing and social engineering, leaving organizations and users at high risk of being compromised. Any such access, disclosure, or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, regulatory penalties, a disruption of the Company’s operations, damage to its reputation, a loss of confidence in the Company’s business, early termination of its contracts and other business losses, indemnification of its customers, liability for stolen assets or information, increased cybersecurity protection and insurance costs, financial penalties, litigation, regulatory investigations and other significant liabilities, any of which could materially harm and adversely affect the Company’s business, revenues, and competitive position.

| 19 |

The Company is dependent on third parties to, among other things, maintain its servers, provide the bandwidth necessary to transmit content, and utilize the content derived therefrom for the potential generation of revenues.

The Company depends on third-party service providers, suppliers, and licensors to supply some of the services, hardware, software, and operational support necessary to provide some of its products and services. Some of these third parties do not have a long operating history or may not be able to continue to supply the equipment and services the Company desires in the future. If demand exceeds these vendors’ capacity, or if these vendors experience operating or financial difficulties or are otherwise unable to provide the equipment or services the Company needs in a timely manner, at its specifications and at reasonable prices, the Company’s ability to provide some products and services might be materially adversely affected, or the need to procure or develop alternative sources of the affected materials or services might delay its ability to serve its users. These events could materially and adversely affect the Company’s ability to retain and attract users, and have a material negative impact on its operations, business, financial results, and financial condition.

Because the Company does not intend to pay any cash dividends on its shares of common stock in the near future, shareholders will not be able to receive a return on their shares unless and until they sell them.

The Company intends to retain a significant portion of any future earnings to finance the development, operation and expansion of its business. The Company does not anticipate paying any cash dividends on its Common Stock in the near future. The declaration, payment, and amount of any future dividends will be made at the discretion of the Company Board of Directors, and will depend upon, among other things, the results of operations, cash flows, and financial condition, operating and capital requirements, and other factors as its Board of Directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless the Board of Directors determines to pay dividends, Shareholders will be required to look to appreciation of the Company’s Common Stock to realize a gain on their investment. There can be no assurance that this appreciation will occur.

The Company is dependent on key personnel.

The Company’s continued success will depend, to a significant extent, on the services of its Directors, executive management team, and key personnel. If one or more of these individuals were to leave, there is no guarantee the Company could replace them with qualified individuals in a timely or economically satisfactory manner or at all. The loss or unavailability of any or all of these individuals could harm the Company’s ability to execute its business plan, maintain important business relationships and complete certain product development initiatives, which would have a material adverse effect on its business, results of operations and financial conditions.

The Company may not be able to successfully execute the business plan.

The Company is raising significant amounts of capital in order to scale its operations. This will allow the Company to expand its operations and continue to build out its business model. There is no guarantee that the Company will be able to achieve or sustain the foregoing within the anticipated timeframe, or at all – even though the Company’s Directors and Officers are industry professionals. The Company may exceed the budget, encounter obstacles in development activities, or be hindered or delayed in implementing the Company’s plans, any of which could imperil the Company’s ability to execute its business plan.

The Company is a new company with a brief operating history, no revenue and an untested business plan which may not be accepted in the markets in which it intends to operate.

The Company was formed in Nevada in October 2020 and will encounter difficulties, including unforeseen difficulties as an early-stage, pre-revenue company in establishing the credibility of its brand and service.

The Company will incur net losses in the foreseeable future if it is unable to anticipate market trends and match its service offerings to market patterns. The Company’s business strategy is unproven, and it may not be successful in addressing early-stage challenges, such as establishing the Company’s position in the market and developing effective marketing of its Thumzup® App. To implement its business plan, the Company will be required to obtain additional financing but cannot guaranty that such additional financing will be available.

| 20 |

The Company’s prospects must be considered highly speculative, considering the risks, expenses, and difficulties frequently encountered in the establishment of a new business with an unproven business plan, specifically the risks inherent in developmental stage companies seeking to have mobile app users with limited number social media followers endorse products or services at a level that Advertisers will seek to fund and support. The Company expects to continue to incur significant operating and capital expenditures and, as a result, it expects significant net losses in the future. The Company cannot assure that it will be able to achieve positive cash flow operations or, if achieved, that positive cash can be maintained for any significant period, or at all.

Although the Company believes that its business strategy addresses an underserved but significant niche of market segment utilizing important Creators or consumers whom it defines as “micro-influencers,” the Company may not be successful in the implementation of its business strategy or its business strategy may not be successful, either of which will impede the Company’s development and growth. The Company’s business strategy involves attracting a large number of Creators who are active in social media and who are willing to make recommendations over the Thumzup® App with Advertisers who find the Company’s service cost effective in generating sales and market support. The Company’s ability to implement this business strategy is dependent on its ability to:

| ● | predict concerns of Advertisers; | |

| ● | identify and engage Advertisers; | |

| ● | convince a large number of end users to adopt the Thumzup® App; | |

| ● | establish brand recognition and customer loyalty; and | |

| ● | manage growth in administrative overhead costs during the initiation of the Company’s business efforts. |

The Company does not know whether it will be able to successfully implement its business strategy or whether the Company’s business strategy will ultimately be successful. In assessing the Company’s ability to meet these challenges, a potential Investor should consider the Company’s lack of operating history and brand recognition, its focus on nano-influencer Creators, management’s relative inexperience, the competitive conditions existing in its industry and general economic conditions and consumer discretionary spending habits. The Company’s growth is largely dependent on its ability to successfully implement its business strategy. The Company’s revenue may be adversely affected if it fails to implement its business strategy or if the Company diverts resources to a business strategy that ultimately proves unsuccessful.

The Company has not yet established brand identity and customer loyalty.

The Company believes that establishing and maintaining brand identity and brand loyalty is critical to attracting and retaining active users to the Thumzup® App program. In order to attract Thumzup® App Creators to the Company’s program quarter over quarter, the Company may need to spend substantial funds to create and maintain brand recognition among Thumzup® App users. If the Company’s branding efforts are not successful, its ability to earn revenues and sustain its operations will be materially impaired.

Promotion and enhancement of the Thumzup® App will also depend on the Company’s success in consistently providing high-quality, ease-of-use, fun-to-share products or recommended services to the Company’s App users. Since the Company relies on technology partners to provide portions of the service to its customers, if the Company’s suppliers do not send accurate and timely data, or if its customers do not perceive the products it offers as attractive or superior, the value of the Thumzup® brand could be harmed. Any brand impairment or dilution could decrease the attractiveness of Thumzup® to one or more of these groups, which could harm the Company’s business, results of operations and financial condition.

The Company cannot assure investors that the Thumzup® App will be accepted.

Anticipation of demand and market acceptance of service offerings are subject to a high level of uncertainty and challenges to implementation. The success of the Company’s service offerings primarily depends on the interest of Creators joining its service, as to which it cannot assure to prospective Investors. In general, achieving market acceptance for the Company’s services will require substantial marketing efforts and the expenditure of significant funds, the availability of which the Company cannot be assured, to create awareness and demand among customers. The Company has limited financial, personnel and other resources to undertake extensive marketing activities. Accordingly, no assurance can be given as to the acceptance of the Thumzup® App services or the Company’s ability to generate the revenues necessary to remain in business.

| 21 |

A better financed competitor may enter the marketplace, cause the Company’s market share or acceptance rates to plummet and adversely affect its ability to sustain viable operations.

While platforms are in operation for professional or large-scale influencers, to the Company’s knowledge no other company is currently offering Advertisers a scalable platform to activate everyday end-user micro-influencers who do not possess a large legion of followers. The success of the Company’s service offerings primarily depends on the interest of Creators and Advertisers joining its service, as opposed to a similar service offered by a competitor catering to celebrities or other large-scale influencers. If a direct competitor having greater human and cash resources enters the market targeting micro-influencers, the Company’s achieving market acceptance for the Thumzup® App may require additional marketing efforts and the expenditure of significant funds to create awareness and demand among customers. The Company has limited financial, personnel and other resources to undertake additional marketing activities. Accordingly, the Company may be unable to compete, its operations may suffer, and it may suffer greater losses.

Although the Company may own various intellectual property rights, these rights may not provide it with any competitive advantage.

The Company uses “Thumzup®” as a brand name, however it cannot assure prospective Investors that the services it sells, or that its brand name will not infringe on the intellectual property rights of others, or that the Company’s assertions of intellectual property rights will be enforceable or provide protection against competitive products or otherwise be commercially valuable. Moreover, enforcement of intellectual property rights typically requires time-consuming and costly litigation, and the Company cannot assure that others will not independently develop substantially similar products.

The Company’s future financial results are uncertain and its operating results may fluctuate, due to, among other things, consumer trends, the impact of COVID on advertising budgets and App user activity, competition, and changing social media behaviors.

As a result of the Company’s lack of operating history, it is unable to forecast market penetration or anticipated revenue and it has little historical financial data upon which to base planned operating expenses. The Company bases its current and future expense levels on its operating plans and estimates of future expenses. The Company’s expenses are dependent in large part upon expenses associated with its proposed marketing expenditures and related overhead expenses, and the costs of hiring and maintaining qualified personnel to carry out its respective services. Sales and operating results are difficult to forecast because they will depend on the growth of the Company’s customer base, changes in customer demands based on consumer trends, the degree of utilization of its advertising services as well as the mix of products and services sold by its Advertisers.

As a result, the Company may be unable to make accurate financial forecasts and adjust its spending in a timely manner to compensate for any unexpected revenue shortfall. This inability could cause the Company’s net losses in a given quarter to be greater than expected and could further cause continuing greater losses quarter over quarter.

The Company’s ability to succeed will depend on the ability of its management to control costs.

The Company has used reasonable commercial efforts to assess and predict costs and expenses based on the and restricted cash experience of its management. However, the Company has a limited operating history upon which to base predictions. Implementing its business plan may require more employees, equipment, supplies or other expenditure items than the Company has predicted. Similarly, the cost of compensating additional management, employees and consultants or other operating costs may be more than its estimates, which could result in sustained losses.

| 22 |

Key personnel of the Company do not devote full time to the affairs of the Company and could allocate their time and attention to other business ventures which may not benefit the Company.

The Company’s Officers and Directors may engage in other activities. Although there are none known to the Company, the potential for conflicts of interest exists among the Officers, Directors, and affiliated persons for future business opportunities that may not be presented to the Company. The Company’s Officers and Directors may have conflicts of interests in allocating time, services, and functions between the other business ventures in which those persons may be or become involved. The Company’s Officers and Directors however believe that the business will have sufficient staff, consultants, employees, agents, contractors, and managers to adequately conduct its business.

The Company’s Officers, Directors, and employees are entitled to receive compensation, payments and reimbursements, regardless of whether it operates at a profit or a loss.

Any compensation received by the Officers, management personnel, and Directors, and for the Company’s founders will be determined from time to time by the Board of Directors. The Company’s Officers, Directors and management personnel will be reimbursed for any out-of-pocket expenses incurred on their behalf.

Combination or “layering” of multiple risk factors may significantly increase the risk of loss on share of the Company’s common stock.

Although the various risks discussed in this Offering Circular are generally described separately, investors should consider the potential effects of the interplay of multiple risk factors. Where more than one significant risk factor is present, the risk of loss to an investor may be significantly increased. In considering the potential effects of layered risks, an Investor should carefully review the descriptions of the shares.

Our business is sensitive to consumer spending, inflation and economic conditions.

Consumer purchases of discretionary retail items and restaurants may be adversely affected by national and regional economic, market and other conditions such as employment levels, salary and wage levels, the availability of consumer credit, inflation, high interest rates, high tax rates, high fuel prices, the threat of a pandemic or other health crisis (such as COVID-19) and consumer confidence with respect to current and future economic, market and other conditions. Consumer purchases may decline during recessionary periods or at other times when unemployment is higher or disposable income is lower. These risks may be exacerbated for retailers such as our Advertisers. Consumer willingness to make discretionary purchases may decline, may stall or may be slow to increase due to national and regional economic conditions. Our financial performance is particularly susceptible to economic and other conditions in regions or states where we have a significant presence. There remains considerable uncertainty and volatility in the national and global economy. Further or future slowdowns or disruptions in the economy, market and other conditions could adversely affect mall traffic and new mall and shopping center development and could materially and adversely affect us and our business strategy. We may not be able to sustain or increase our current net sales if there is a decline in consumer spending.

A deterioration of economic conditions and future recessionary periods may exacerbate the other risks faced by our business, including those risks we encounter as we attempt to execute our business plans. Such risks could be exacerbated individually or collectively.

Russia’s Invasion of Ukraine may negatively impact our business.

On February 24, 2022, Russia launched an invasion of Ukraine which has resulted in increased volatility in various financial markets and across various sectors. The United States and other countries, along with certain international organizations, have imposed economic sanctions on Russia and certain Russian individuals, banking entities and corporations as a response to the invasion. The extent and duration of the military action, resulting sanctions and future market disruptions in the region are impossible to predict. Moreover, the ongoing effects of the hostilities and sanctions may not be limited to Russia and Russian companies and may spill over to and negatively impact other regional and global economic markets of the world, including Europe and the United States. The ongoing military action along with the potential for a wider or nuclear conflict could further increase financial market volatility and cause negative effects on regional and global economic markets, industries, and companies. It is not currently possible to determine the severity of any potential adverse impact of this event on the financial condition of any of the Company’s securities, or more broadly, upon the global economy.

| 23 |

Several of our outsourced developers are based in Pakistan and our product development could be impacted by conflict in the Middle East.

Pakistan’s economy is heavily dependent on exports and subject to high interest rates, economic volatility, inflation, currency devaluations, high unemployment rates and high level of debt and public spending. There is also the possibility of nationalization, expropriation or confiscatory taxation, security market restrictions, political changes, government regulation, a conflict with India, or diplomatic developments (including war or terrorist attacks), which could affect adversely the economy of Pakistan or the ability of the Company to continue developing its platform. As an emerging country, Pakistan’s economy is susceptible to economic, political and social instability; unanticipated economic, political or social developments could impact economic growth. Pakistan is also subject to natural disaster risk. In addition, recent political instability and protests in the Middle East have caused significant disruptions to many industries. Pakistan has recently seen elevated levels of ethnic and religious conflict, in some cases resulting in violence or acts of terrorism. Continued political and social unrest in these areas may negatively affect the Company.

We rely on third-party internal and outsourced software to run our critical development and information systems. As a result, any sudden loss, disruption or unexpected costs to maintain these systems could significantly increase our operational expense and disrupt the management of our business operations.

We rely on third-party software to run our critical development and information systems. We also depend on our software vendors to provide long-term software maintenance support for our information systems. Software vendors may decide to discontinue further development, integration or long-term software maintenance support for our information systems, in which case we may need to abandon one or more of our current information systems and migrate some or all of our development and information systems, thus increasing our operational expense as well as disrupting the management of our business operations.

Cyber security breaches of our systems and information technology could adversely impact our ability to operate.

We need to protect our own internal trade secrets, work product for our clients, and other business confidential information from disclosure. We face the threat to our computer systems of unauthorized access, computer hackers, computer viruses, malicious code, organized cyber-attacks and other security problems and system disruptions, including possible unauthorized access to our and our clients’ proprietary or classified information.

We rely on industry-accepted security measures and technology to maintain securely all confidential and proprietary information on our information systems. We have devoted and will continue to devote significant resources to the security of our computer systems, but they are still vulnerable to these threats. A user who circumvents security measures can misappropriate confidential or proprietary information, including information regarding us, our personnel and/or our clients, or cause interruptions or malfunctions in operations. Our industry has not been immune from organized cyber-attacks from persons seeking a ransom as a condition of releasing access to the firm’s computer systems. As a result, we can be required to expend significant resources to protect against the threat of these system disruptions and security breaches or to alleviate problems caused by these disruptions and breaches. Any of these events can damage our reputation and have a material adverse effect on our business, financial condition, results of operations and cash flows.

Risks Related to the Common Stock

There can be no assurance that our Common Stock will ever be approved for listing on a national securities exchange. Failure to develop or maintain an active trading market could negatively affect the value of our Common Stock and make it difficult or impossible for investors to sell their shares in a timely manner.